Campers raised $619 for the Animal Shelter of Northeast Nebraska.

Category: Blog Posts

Be Aware of Fraudulent IRS Communications

In today’s digital age, scams and fraud have become increasingly prevalent, affecting individuals, businesses, and government agencies. One of the most common forms of fraud involves impersonating the Internal Revenue Service (IRS) to deceive taxpayers. To protect ourselves and our communities from falling victim to such schemes, it is essential to be aware of fraudulent IRS communications via phone, email, text messages, or social media.

Here is a hypothetical scenario of fraudulent communications:

Paula received a voicemail from an IRS employee asking for a call back on a toll-free number. She is current on her tax filing requirements and doesn’t owe any back taxes. So, she’s confused about why the IRS would contact her.

Paula is justified in being concerned. The IRS does not initiate contact with taxpayers by phone, email, text messages, or social media channels. Official IRS correspondence is sent through the US Postal Service. The letter provides detailed information regarding tax issues such as notices about discrepancies, bills for unpaid taxes, or requests for additional information.

Sometimes, the IRS may call taxpayers, but this is not common and usually follows an initial letter. During these calls, representatives never demand immediate payment or ask for credit card information over the phone.

Paula should call the IRS directly at 1-800-829-1040, not on the number left in the voicemail.

If you are experiencing tax scams, please report them to the IRS immediately. Click here for the contact information.

Client Profile is based on a hypothetical situation. The solutions discussed may or may not be appropriate for you.

source: https://e.clientlinenewsletter.com/mcmillcpasandadvisors

Roll Over Excess 529 Funds to a Roth IRA

Starting in 2024, 529 educational savings plans will become even more attractive with enhanced tax benefits. If your student receives scholarships or joins the military, there is a new option for handling excess 529 plan funds.

SECURE 2.0

The SECURE Act 2.0, which became law late in 2022, enables 529 beneficiaries to place unused 529 funds into their Roth IRA – without penalty. Understand that the rollover can only be made to the 529 beneficiary’s Roth IRA – not a parent’s Roth IRA.

This new rule can have an incredible impact on the student’s ability to successfully fund a comfortable retirement, thanks to the power of compound interest.

OTHER OPTIONS

You still have the option of changing a 529 plan beneficiary to another qualifying family member. But the funds would have to be used for educational purposes. Alternatively, you could withdraw excess funds and pay a 10% penalty.

OBEY THE RULES

As with most tax laws, numerous rules govern a 529 plan to Roth IRA rollover. Keep these in mind:

- A max of $35,000 can be rolled over from a 529 plan to a beneficiary’s Roth IRA.

- Annual Roth IRA contribution limits apply to rollovers. (For example, if this law was already in effect, the 2023 ROTH IRA contribution limit is $6,500, which means it would take six years to convert $35,000 from a 529 plan to a Roth IRA).

- Conversions can only be made to a beneficiary’s Roth IRA; a parent saving with a 529 plan in a child’s name cannot convert unused funds back into their own retirement account.

- Rollovers are not allowed until a 529 account has been open for at least 15 years.

- Funds you convert from 529 plans to Roth IRAs must have been in the account for at least five years.

Consult your tax professional to learn more.

Click here to check out our SECURE 2.0 Resource Center.

source: https://e.clientlinenewsletter.com/mcmillcpasandadvisors

Liberty Bell Park – Design Day

KABOOM! is in partnership with Integrity Marketing Group, a Dallas-based firm, and local businesses Premier Senior Marketing, Retirement Plan Consultants (RPC) and Wealth Management to bring a new playground to Liberty Bell Park.

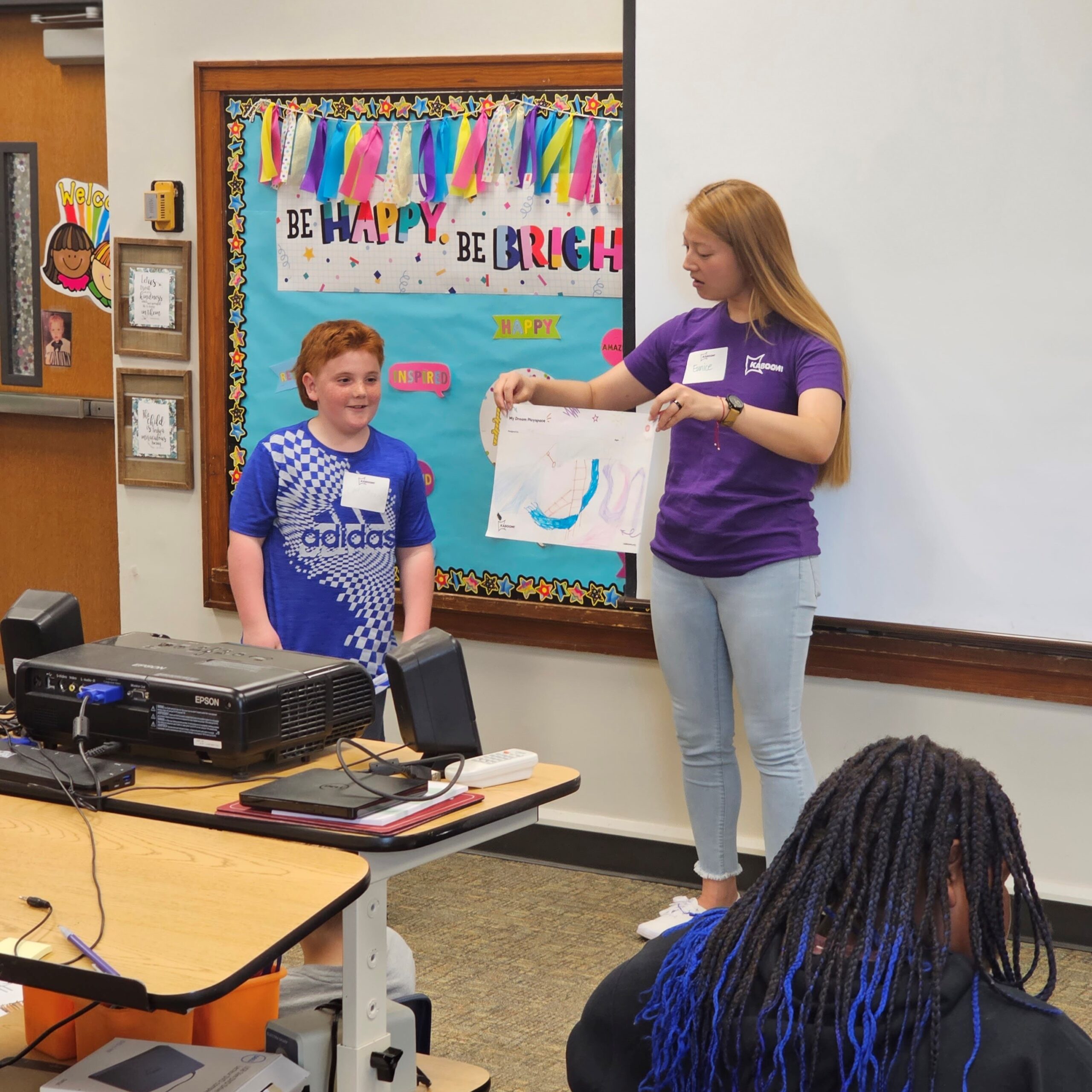

KABOOM! provided dream pads to all Norfolk elementary school students which were available for viewing at the adult session of Design Day. Click here to see the full video of the student’s drawings.

Design Day was held on May 11th and was kicked off with the kid design session at Lincoln Montessori. The adult session was held at McMill’s Courtroom in the afternoon. The session was hosted by KABOOM! to gain insights on what the public wants at the new park including equipment and colors.

As part of the partnership, the City will contribute $8,500 with the remaining $150,000 for the project provided by Integrity Marketing Group, Premier Senior Marketing and Retirement Plan Consultants (RPC) and Wealth Management.

Spring Into Service – April 2023

RPC employees volunteer at local organizations and charities.

In April 2023, RPC employees were encourage to serve at their favorite non-profit organizations. Employees volunteered at 4 charities and served a total of 116 hours!

SECURE Act 2.0 For Businesses

Building on the 2019 SECURE ACT, the 2022 Securing a Strong Retirement Act (commonly referred to as SECURE 2.0) was passed to help boost savings in workplace plans, extend support to small businesses that want to help employees prepare for retirement, and increase tax incentives for small businesses. Here are some of the corporate highlights.

TAX CREDITS RISE

SECURE 2.0 increases the startup credit to cover 100% (up from 50%) of administrative costs up to $5,000 for the first three years of plans established by employers with up to 50 employees. It also clarifies that small businesses joining a multiple employer plan (MEP) are eligible for the credit.

AUTO-ENROLLMENT EXPANDS

Beginning in 2025, 401(k) and 403(b) plans will be required to automatically enroll eligible participants, though employees may opt out of coverage. There is an exception for small businesses with ten or fewer employees and new companies less than three years old. The expansion of automatic enrollment will help more workers save for retirement, particularly younger, lower-paid workers.

STARTER PLANS AVAILABLE

Next year, employers who do not already offer retirement plans will be permitted to provide a starter 401(k) plan, or safe harbor 403(b) plan to employees who meet age and service requirements. Through the starter plans, the limit on annual deferrals would be the same as the IRA contribution limit, and employers may not make matching or nonelective contributions to starter plans.

PART-TIME WORKERS BENEFIT

Starting in 2025, employers will be required to allow part-time employees (workers with over 500 hours per year for two consecutive years) to participate in their retirement plan after two years of service. Employees with over 1,000 hours of service must be included after one year of service.

SECURE 2.0 also made numerous changes to how company retirement plans operate. You’ll need to understand how these changes will impact your business—especially if you want to include a retirement plan in your employee benefits package.

source: https://e.clientlinenewsletter.com/mcmillcpasandadvisors

Easing Into Retirement or Semi-Retirement

Retirement is not a single event. It is a process that begins long before you leave work and continues for the rest of your life. Here are some tips on how to transition into retirement and beyond.

CONSOLIDATE AND SIMPLIFY

Consolidate your retirement accounts for simplicity. Combining accounts makes managing your money and seeing the big picture easier.

Fewer accounts mean fewer monthly or quarterly statements, fewer companies to notify if you move or want to change beneficiaries, and possibly lower costs. It can also make calculating RMDs easier.

EXAMINE THE NUMBERS

As you move away from working full-time, be sure your monthly and annual budgets are up to date. Include existing expenses that aren’t likely to change, such as groceries and utility bills.

Don’t forget to include new expenses you may incur in retirement. This includes healthcare costs your employer may have paid for or taxes when you withdraw from tax-deferred retirement accounts.

UPDATE YOUR PLANS

If it’s been a while since you’ve reviewed your estate planning documents, nearing retirement is a good time for a refresher.

While you may focus on ensuring your will and trust documents are up to date, don’t forget about your power of attorney, health care directives and guardian nominations.

If your retirement plans include relocating to a new state, consult an attorney in the new location to ensure your estate documents will be valid in that state. Having out-of-state documents can complicate trust and estate adminstration.

When you update your estate plan, remember to create a list of your accounts and assets and update that list as things change. It is not important to add a value to the account, as those change over time. Make sure to include the name and location of the account and the last four digits of the account number. It is one of the most important things you can do for your beneficiaries to avoid a time-consuming treasure hunt for your assets when you’re gone.

source: https://e.clientlinenewsletter.com/mcmillcpasandadvisors

Generation-Skipping Transfer Tax Basics

The generation-skipping transfer tax (GSTT) is another transfer tax akin to the gift and estate tax.

WHAT IS THE GSTT

The GSTT applies to all transfers made by gift or inheritance to any person considered a “skip person”. A skip person is someone who is at least two generations below you. The most common skip person is a grandchild because you’re skipping over your child.

One example would be writing a $30,000 check to a grandson for a down payment on a house. This gift would skip your own child, thus avoiding the possible gift tax that would apply if the gift had passed from you to your child and then from your child to your grandchild. Therefore, it is subject to the GSTT.

The GSTT ensures that grandchildren end up with the same value of assets that they would have had if the inheritance was transferred to them directly from their parents rather than their grandparents.

LIMITS

A taxpayer can gift up to $17,000 tax-free to a recipient in 2023. And the total estate and gift tax exemption is $12.92 million. Only the value of the taxpayer’s estate at death that is over this exemption amount is subject to the GSTT. Any GSTT due is paid by the donor’s estate.

THE FUTURE

The provisions relating to the GSTT exemption in the current tax law will sunset at the end of 2025. This means that as of January 1, 2026, the GSTT exemption will revert to the amount that was allowed under the law effective in 2017 (an inflation-adjusted $5 million, or about half of what is currently allowed). Therefore, if you are considering taking advantage of the higher current exemption amounts, the time to do so is limited, unless Congress acts to change the law once again.

source: https://e.clientlinenewsletter.com/mcmillcpasandadvisors

How the SECURE 2.0 Act will Impact your Retirement Plan in 2024

Legislative Highlights

As the SECURE 2.0 Act makes its way through the headlines, plan sponsors may start to feel overwhelmed by the many provisions contained within this Act. To help alleviate some of this concern, plan sponsors may want to focus on the provisions that are both mandatory and will be effective within the next 2 years.

Many of the provisions effective in 2024 will make a profound impact on plan design and how participants will save for the future. It’s important for plan sponsors and service providers to become familiar with these provisions so they can plan accordingly.

Although this new legislation includes over 90 provisions, the following provides a high-level summary of selected provisions that are effective in 2024.

Indexing IRA catch-up limit – The current limit on IRA contributions is increased by $1,000 for individuals who are age 50 and older. This Act allows the limit to be indexed to inflation, meaning it could increase every year, based on federally determined cost-of-living increases.

- Effective for taxable years beginning after December 31, 2023.

- Applicable plans: IRAs

Treatment of student loan payments as elective deferrals for purposes of matching contributions – This section allows employees to receive matching contributions on student loan repayments. An employer is permitted to match student loan payments under 401(k), 403(b), SIMPLE, and 457(b) plans as if those payments were elective deferrals. For purposes of the nondiscrimination test applicable to elective contributions, a plan is permitted to test separately the employees who receive matching contributions on student loan repayments.

- Effective for contributions made for plan years beginning after December 31, 2023.

- Applicable plans: 401(k), 403(b), governmental 457(b) plans, and SIMPLE IRAs

Withdrawals for certain emergency expenses. Generally, an additional 10% penalty tax applies to early distributions from tax-preferred retirement accounts, unless an exception applies. The new law would permit participants to withdraw up to $1,000 in a year from their retirement account to pay for an emergency. They must repay the $1,000 distribution within 3 years or no further emergency distributions are permissible during the 3-year repayment period.

- Effective for distributions made after December 31, 2023.

- Applicable plans: 401(a) (except pension plans), 401(k), 403(b), governmental 457(b) plans and traditional IRAs

Allow additional nonelective contributions to SIMPLE plans – Current law requires employers with SIMPLE plans to make employer contributions to employees of either a nonelective contribution of 2% of compensation, or a matching contribution equal to the lesser of the employee’s elective deferral contribution or 3% of compensation. An employer is now permitted to make additional contributions in a uniform manner, to each eligible employee who has at least $5,000 of compensation from the employer for the year. The contribution may not exceed the lesser of up to 10% of compensation or $5,000 (indexed).

- Effective for taxable years beginning after December 31, 2023.

- Applicable plans: Simple IRA and Simple 401(k) plans

Contribution limit for SIMPLE plans – This Act automatically increases the annual deferral limit and the catch-up contribution at age 50 by 10% in the case of an employer with no more than 25 employees. An employer with 26 to 100 employees would be permitted to provide higher deferral limits, but only if the employer either provides a 4% of pay matching contribution (up from 3%) or a 3% of pay employer nonelective contribution (up from 2%). This provision makes similar changes to the contribution limits for SIMPLE 401(k) plans.

- Effective for taxable years beginning after December 31, 2023.

- Applicable plans: Simple IRA and Simple 401(k) plans

Exemption for certain automatic portability transactions – Under current law, an employer is permitted to distribute a participant’s account balance without participant consent if the balance is under $5,000 and the balance is immediately distributable (e.g., after a termination of employment). Current law also requires an employer to roll over this distribution into a default IRA if the account balance is at least $1,000 and the participant does not affirmatively elect otherwise.

A retirement plan service provider is now permitted to provide employer plans with automatic portability services. Such services involve the automatic transfer of a participant’s default IRA (established in connection with a distribution from a former employer’s plan) into the participant’s new employer’s retirement plan, unless the participant affirmatively elects otherwise.

- Effective for transactions occurring on or after the date which is 12 months after the date of enactment of this Act, December 29, 2022.

- Applicable plans: 401(a), 401(k), 403(b), and governmental 457(b) plans, SEPs, and SIMPLE plans all with less than 100 employees

Starter 401(k) and safe harbor 403(b) plans for employers with no retirement plan – Permits an employer that does not sponsor a retirement plan to offer a starter 401(k) plan (or safe harbor 403(b) plan). A starter 401(k) plan (or safe harbor 403(b) plan) would generally require that all employees be automatically enrolled in the plan at a 3% to 15% of compensation deferral rate. The limit on annual deferrals would be the same as the IRA contribution limit, which for 2023 is $6,500 with an additional $1,000 in catch-up contributions beginning at age 50. Plan is not required to perform deferral nondiscrimination testing (ADP testing) and top heavy rules do not apply.

The safe harbor 403(b) rules are similar to the starter 401(k) plan rules, but ADP testing does not apply to 403(b) plans due to the universal availability rules. Top-heavy rules do not apply as well. We see little benefit to a safe harbor 403(b) plan for these reasons.

- Effective for plan years beginning after December 31, 2023.

- Applicable plans: 401(k) and 403(b) plans

Special rules for certain distributions from long-term qualified tuition programs to Roth IRAs – Amends the Internal Revenue Code to allow for tax and penalty free rollovers from 529 accounts to Roth IRAs, under certain conditions. Beneficiaries of 529 college savings accounts would be permitted to rollover up to $35,000 over the course of their lifetime from any 529 account in their name to their Roth IRA. These rollovers are also subject to Roth IRA annual contribution limits, and the 529 account must have been open for more than 15 years.

- Effective with respect to distributions after December 31, 2023.

- Applicable plans: 529 accounts and Roth IRAs

Emergency savings accounts linked to individual account plans – Provides employers the option to offer their non-highly compensated employees pension-linked emergency savings accounts. Employers may automatically opt employees into these accounts at no more than 3% of their salary, and the portion of an account attributable to the employee’s contribution is capped at $2,500 (or lower as set by the employer). Once the cap is reached, the additional contributions can be directed to the employee’s Roth defined contribution plan or stopped until the balance attributable to contributions falls below the cap. Contributions are made on a Roth-like basis and are treated as elective deferrals for purposes of retirement matching contributions with an annual matching cap set at the maximum account balance – e.g., $2,500 or lower as set by the plan sponsor. The first four withdrawals from the account each year may not be subject to any distribution fees or charges. At separation from service, employees may take their emergency savings accounts as cash or roll it into their Roth defined contribution plan or IRA.

- Effective for plan years beginning after December 31, 2023.

- Applicable plans: 401(k), 403(b), and governmental 457(b) plans

Updating dollar limit for mandatory distributions – Under current law, employers may automatically roll over former employees’ retirement accounts from a workplace retirement plan into an IRA if their balances are between $1,000 and $5,000. This limit will now be increased from $5,000 to $7,000.

- Effective for distributions made after December 31, 2023.

- Applicable plans: 401(a), 401(k), 403(b), and governmental 457(b) plans

Expansion of the Employee Compliance Resolution System (EPCRS) – The law expands EPCRS to allow more types of errors to be corrected under the self-correction method. There is no time limit to correct unless the self-correction is not completed within a reasonable time period after the failure is identified, or the IRS catches the failure before “any actions which demonstrate a specific commitment to implement a self-correction with respect to such failure.” Also, EPCRS is to be updated to apply to inadvertent IRA errors, including exempting certain failures to make required minimum distributions from the otherwise applicable excise tax.

- Effective date – the IRS is required to update the EPCRS revenue procedure no later than December 29, 2024. It is unclear whether employers can rely on the law in the meantime.

- Applicable plans: 401(a), 401(k), and 403(b) plans

Application of top-heavy rules to defined contribution plans covering excludable employees – Under current law, if an employer of a top-heavy plan allows employees to participate in a plan earlier than one year of service and age 21, the employer may be required to make a 3% of pay top-heavy contribution for non-key employees. This is an expensive burden for small employers. Secure 2.0 allows an employer to treat employees who have not attained the age of 21 and worked one year of service as a separate group for purposes of top-heavy minimum contributions in a defined contribution plan. Bottom line, employers do not need to make a top-heavy contribution to the plan on behalf of these participants who are allowed to defer early into the plan. This removes the financial incentive to exclude employees from the 401(k) plan and increase retirement plan coverage to more workers.

- Effective for plan years beginning after December 31, 2023.

- Applicable plans: 401(a) defined contribution plans and 401(k) plans

Penalty-free withdrawal from retirement plans for individual case of domestic abuse – Allows retirement plans to permit participants that self-certify that they experienced domestic abuse to withdraw a small amount of money (the lesser of $10,000, indexed for inflation, or 50% of the participant’s vested account). A distribution made under this provision is not subject to the 10% tax on early distributions. Additionally, a participant has the opportunity to repay the withdrawn money from the retirement plan over 3 years and will be refunded for income taxes on money that is repaid.

- Effective for distributions made after December 31, 2023.

- Applicable plans: 401(a) defined contribution plans with no qualified joint and survivor annuity distribution options, 401(k) and 403(b) plans; governmental 457(b) plans

Reform of family attribution rule – The aggregation rules that determine the degree of common ownership in a business have been updated in two situations:

- Addresses inequities where spouses with separate businesses reside in a community property state when compared to spouses who reside in separate property states.

- Modifies the attribution of stock between parents and minor children.

- Effective for plan years beginning after December 31, 2023.

- Applicable plans: 401(a), 401(k), and 403(b) plans

Increased time period to adopt beneficial plan amendments – The Act allows discretionary amendments that increase participants’ benefits or nonelective contributions to be adopted by the due date of the employer’s tax return, plus extensions, rather than by the end of the plan year in which the amendment is effective. This does not apply to matching contributions and the amendment must be consistent with other typical requirements, e.g., must meet nondiscrimination requirements.

- Effective for plan years beginning after December 31, 2023.

- Applicable plans: 401(a) and 401(k) plans

Clarification of substantially equal periodic payment rule – Current law imposes a 10% additional tax on early distributions from tax-preferred retirement accounts, but an exception applies to substantially equal periodic payments that are made over the account owner’s life expectancy. This provision provides that the exception continues to apply in the case of a rollover, exchange of an annuity providing the payments, or an annuity that satisfies the required minimum distribution rules.

- Effective for transfers, rollovers, exchanges after December 31, 2023, and effective for annuity distributions on or after the date of enactment of this Act.

- Applicable plans: 401(a), 401(k), 403(b) plans, and traditional IRAs

Roth plan distribution rules – Under current law, required minimum distributions (RMD) are not required to begin prior to the death of the owner of a Roth IRA. However, pre-death distributions (e.g., RMDs starting at age, 70 ½, 72 or 73) are required in the case of the owner of a Roth designated account in an employer retirement plan (e.g., 401(k) plan). The pre-death distribution requirement for Roth accounts in employer plans would now be eliminated, similar to a Roth IRA. This will decrease the amount of RMDs for participants with Roth accounts starting in 2024.

- Effective for taxable years beginning after December 31, 2023. Please not that this does not apply to distributions which are required with respect to years beginning before January 1, 2024 but are permitted to be paid on or after such date.

- Applicable plans: 401(a) defined contribution plans, 401(k), 403(b), and governmental 457(b) plans with a designated Roth feature

Surviving spouse election to be treated as employee – Allows a surviving spouse of a participant who dies before commencing RMDs to elect to be treated as the employee for RMD purposes; thereby delaying when RMDs must commence.

- Effective for calendar years beginning after December 31, 2023.

- Applicable plans: 401(a), 401(k), 403(b) and 457(b) governmental plans

Employers allowed to replace SIMPLE retirement accounts with safe harbor 401(k) plans during a plan year – Allows an employer to replace a SIMPLE IRA plan with a SIMPLE 401(k) plan or other 401(k) plan that requires mandatory employer contributions during a plan year.

- Effective for plan years beginning after December 31, 2023.

- Applicable plans: 401(k) plans

Safe harbor for corrections of employee elective deferral failures – Under current law, employers that adopt a retirement plan with automatic enrollment and automatic escalation features could be subject to significant penalties if any mistake was made even unknowingly. The Internal Revenue Service has issued guidance, Employee Plans Compliance Resolution System (EPCRS), on the correction of failures relating to automatic enrollment of employees into retirement plans. This guidance includes a safe harbor, which expires December 31, 2023, that permits no required employer missed deferral correction, if:

- a 45-day notice is given to the affected employee,

- correct deferrals commence within 9 ½ months after the end of the plan year, and

- the employer provides the employee with any matching contributions that would have been made if the failure had not occurred.

Employers are concerned about the lapse of the safe harbor at the end of 2023. Secure 2.0 made this correction permanent after 2023.

- Effective to errors after December 31, 2023. Missed elective deferrals before December 31, 2023 are covered under the existing EPCRS program.

- Applicable plans: 401(k), 403(b), and governmental 457(b) plans

Hardship withdrawal rules – Under current law, the distribution rules for 401(k) and 403(b) plans are treated differently. This provision conforms the 403(b) rules to the 401(k) rules whereby 403(b) plans may now make hardship distributions from the same contribution sources as 401(k) plans, and 403(b) participants are no longer required to take a loan prior to taking hardship distributions.

- Effective for plan years beginning after December 31, 2023.

- Applicable plan: 403(b) plans

Catch-up contributions for certain participants must be made on a Roth basis – Under current law, catch-up contributions to a qualified retirement plan can be made on a pre-tax or Roth basis. This provision provides all catch-up contributions to qualified retirement plans are subject to Roth tax treatment. Employees with compensation of $145,000 or less are exempt from this requirement.

- Effective for taxable years beginning after December 31, 2023.

- Applicable plans: 401(k), 403(b) or governmental 457(b) plans

Final Thoughts

The SECURE 2.0 Act is one of the most extensive pieces of retirement plan legislation in decades with it impacting virtually all retirement plan types. As a reminder, any plan amendments needed as a result of this new legislation must be adopted by the last day of the first plan year beginning on or after January 1, 2025. (e.g., the deadline for a calendar year plan is December 31, 2025.) This deadline is extended two years for certain governmental and collectively bargained plans.

Rest assured that RPC is working diligently to change our operations to comply with the mandatory SECURE 2.0 provisions that will be effective within the next 2 years. However, the IRS and the DOL must provide guidance on how to administer most of these provisions. The IRS is heavily tasked with providing guidance not only for the 2023 provisions, but provisions that are effective in 2024 and thereafter. Employers may want to delay implementation of any optional provisions until further guidance is provided.

RPC will continue to provide more information around the SECURE 2.0 Act in the coming months.

1-877-800-1114 | RetirementPlanConsultants.info

Retiring in a Slowing Economy

February 2023

A well-thought-out plan for a comfortable retirement is important, even more so in a tough economy.

EXAMINE THE PAST

Start by looking at your spending habits for the last three years and determine if it’s sustainable for the next 20 years. Keeping in mind that most retirees take on a new hobby or activity that usually costs money. Travel, large home improvements, or restoring a classic car can cost thousands of dollars and stress your financial plan.

TIMING IS EVERYTHING

Plan to keep your portfolio diversified, and don’t try to time the market. Selling investments because they are down means you could miss out on a recovery. Stripping emotions out of financial decisions is vital but not always easy. If you’re not confident doing this on your own, work with your financial professional for guidance.

STAY FLEXIBLE

Spending in retirement requires flexibility. You may need to reduce your withdrawals when the market is slowing, but you can increase them when it recovers. Be sure to notice the warning signs of a slowing market, like rising interest rates and higher inflation.

source: https://e.clientlinenewsletter.com/mcmillcpasandadvisors