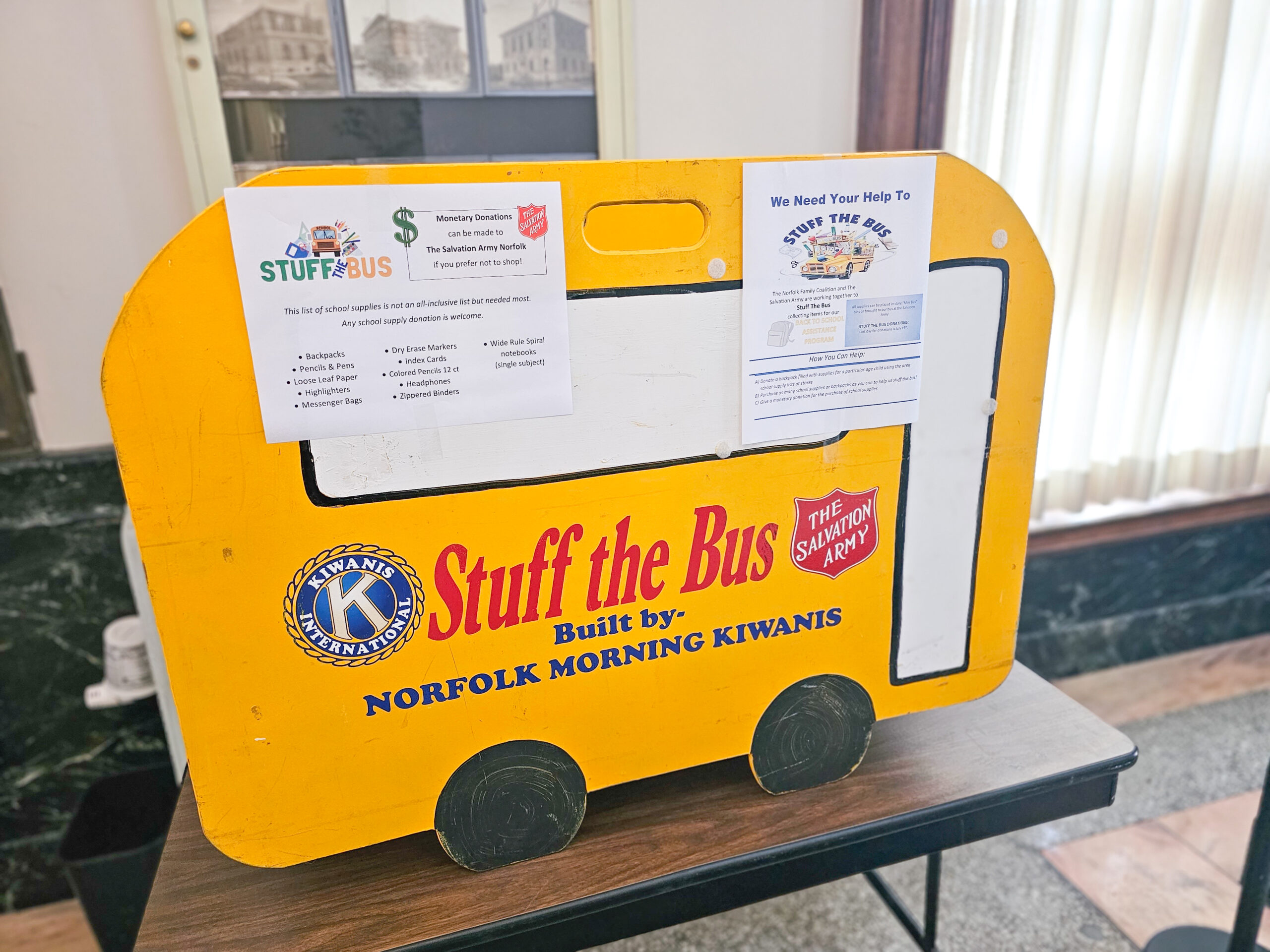

Stuff the Bus

Long-Term Part-Time Employees

The Setting Every Community Up for Retirement Enhancement Act (“SECURE 1.0”) and the revised rules in SECURE 2.0 have introduced a new mandatory eligibility requirement for certain retirement plans. Effective 1/1/2024 some employees who may not otherwise be eligible to participate in the retirement plan will be eligible to make deferrals to the plan as […]

Retirement Plan Consultants Launches App for Plan Participants

Partner Code: RPC At Retirement Plan Consultants, we’re always working to help our retirement plan participants manage their accounts. That’s why we’re so pleased to now offer our new Planlink Mobile App with easy account access and many great features for plan participants. The app is available for participant accounts only, plan sponsors are not […]

Considering Switching 401k Retirement Plan Provider? Start Here!

Looking for a 401k retirement plan provider that truly understands and caters to the unique needs of your clients? Look no further than Retirement Plan Consultants (RPC). Whether you represent a small business or a large company, RPC has the ideal retirement planning solutions for you. We prioritize effective and flexible plans that are tailored […]

RPC and Fee-Based Advisor Partnerships

Retirement planning plays a pivotal role in establishing financial security for families. However, navigating this complex landscape can often leave individuals and employers feeling overwhelmed. At Retirement Plan Consultants (RPC), we understand the challenges that come with retirement planning, which is why we collaborate with fee-based advisors to deliver successful plans that align with the […]

RPC is Leading the Industry in Customer Service

Retirement Plan Consultants (RPC) is not just retirement planning. Our company goes the extra mile to ensure that participants, plan sponsors and financial advisors receive quality customer service. According to ArenaCX, statics show that 69% of customers have stopped doing business with a brand due to negative customer service experiences. Whether you have questions about […]

Qualified Third-Party Administrators for 401(k) Plans

Retirement Plan Consultants (RPC) offers qualified third-party administration for 401(k) plans to provide expertise on plan compliance, design, and consulting. For a streamlined process, RPC also bundles third-party administration with other services such as recordkeeping and fiduciary services. As a financial advisor, recommending bundled retirement plan services showcases your commitment to providing comprehensive retirement planning […]

Integrity Foundation Launches Impactful Nationwide Community Initiative with State-of-the-Art Playground Build in Nebraska

Designed with input from 550 local children, playground was constructed in a single-day build by hundreds of Integrity leaders, employees and community volunteers DALLAS – AUGUST 24, 2023 – Integrity Marketing Group, LLC (“Integrity”), a leading distributor of life and health insurance, and provider of wealth management and retirement planning solutions, today announced the Integrity Foundation has completed […]

Safe Harbor 401(k) Retirement Plan for Employers

What is a Safe Harbor 401(k) Plan? A safe harbor 401(k) plan is a popular retirement plan for small businesses. To qualify as a safe harbor 401(k), there are two requirements: a mandatory contribution and participant notices. By fulfilling these two requirements, the plan can automatically pass annual nondiscrimination testing. This flexible plan is an […]

Profit-Sharing Benefits Employees and Employers

Whether you’re a non-profit organization or small business, there’s opportunity to offer profit-sharing plans to employees, even if you already offer another type of retirement plan. A profit-sharing retirement plan is a plan designed to give employees a share in their company’s profit based on earnings. This plan is available to all sizes of companies […]

401(k) vs. 403(b) – What’s the Difference?

The most well-known retirement plans offered by employers are 401(k) and 403(b) plans. In general, these plans have a lot in common, however, there are a few distinct differences between a 401k vs. 403b that can determine which is the right plan for your business. The main difference is that 401(k) plans are offered by […]

Be Aware of Fraudulent IRS Communications

In today’s digital age, scams and fraud have become increasingly prevalent, affecting individuals, businesses, and government agencies. One of the most common forms of fraud involves impersonating the Internal Revenue Service (IRS) to deceive taxpayers. To protect ourselves and our communities from falling victim to such schemes, it is essential to be aware of fraudulent […]

Roll Over Excess 529 Funds to a Roth IRA

Starting in 2024, 529 educational savings plans will become even more attractive with enhanced tax benefits. If your student receives scholarships or joins the military, there is a new option for handling excess 529 plan funds. SECURE 2.0 The SECURE Act 2.0, which became law late in 2022, enables 529 beneficiaries to place unused 529 […]

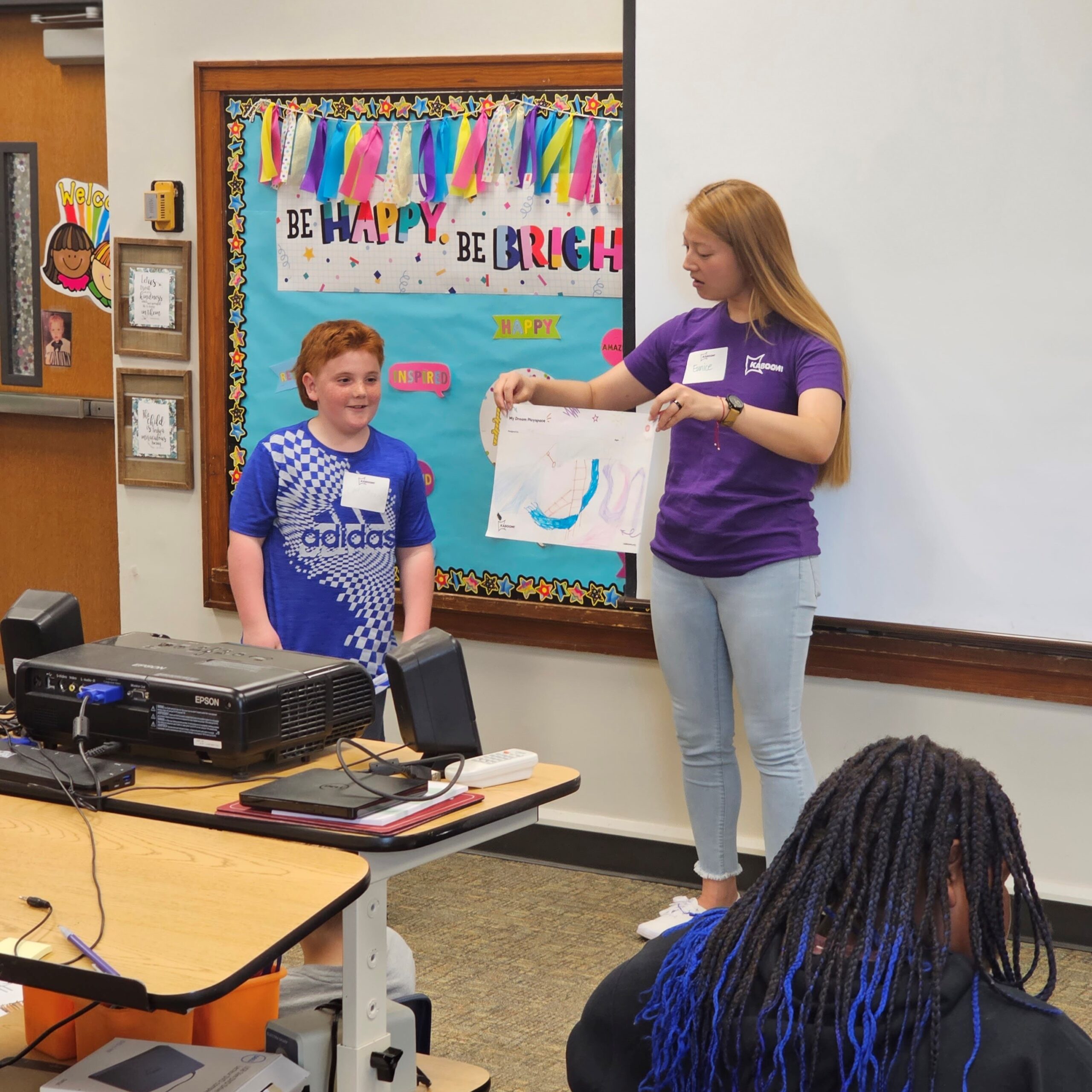

Liberty Bell Park – Design Day

KABOOM! is in partnership with Integrity Marketing Group, a Dallas-based firm, and local businesses Premier Senior Marketing, Retirement Plan Consultants (RPC) and Wealth Management to bring a new playground to Liberty Bell Park. KABOOM! provided dream pads to all Norfolk elementary school students which were available for viewing at the adult session of Design Day. […]

Spring Into Service – April 2023

RPC employees volunteer at local organizations and charities. In April 2023, RPC employees were encourage to serve at their favorite non-profit organizations. Employees volunteered at 4 charities and served a total of 116 hours!

SECURE Act 2.0 For Businesses

Building on the 2019 SECURE ACT, the 2022 Securing a Strong Retirement Act (commonly referred to as SECURE 2.0) was passed to help boost savings in workplace plans, extend support to small businesses that want to help employees prepare for retirement, and increase tax incentives for small businesses. Here are some of the corporate highlights. […]

Easing Into Retirement or Semi-Retirement

Retirement is not a single event. It is a process that begins long before you leave work and continues for the rest of your life. Here are some tips on how to transition into retirement and beyond. CONSOLIDATE AND SIMPLIFY Consolidate your retirement accounts for simplicity. Combining accounts makes managing your money and seeing the […]

Generation-Skipping Transfer Tax Basics

The generation-skipping transfer tax (GSTT) is another transfer tax akin to the gift and estate tax. WHAT IS THE GSTT The GSTT applies to all transfers made by gift or inheritance to any person considered a “skip person”. A skip person is someone who is at least two generations below you. The most common skip […]

How the SECURE 2.0 Act will Impact your Retirement Plan in 2024

Legislative Highlights As the SECURE 2.0 Act makes its way through the headlines, plan sponsors may start to feel overwhelmed by the many provisions contained within this Act. To help alleviate some of this concern, plan sponsors may want to focus on the provisions that are both mandatory and will be effective within the next […]

Retiring in a Slowing Economy

February 2023 A well-thought-out plan for a comfortable retirement is important, even more so in a tough economy. EXAMINE THE PAST Start by looking at your spending habits for the last three years and determine if it’s sustainable for the next 20 years. Keeping in mind that most retirees take on a new hobby or […]

How the Secure 2.0 Act Will Impact Retirement Plans in 2023

Legislative Highlights On December 29, 2022, the Consolidated Appropriations Act of 2023 was signed into law which included the highly anticipated Securing a Strong Retirement Act (SECURE 2.0). This Act brings major changes to the U.S. Retirement System and builds upon the enhancements that were implemented under the SECURE Act of 2019. This legislation includes […]

Updating Your W-4

The start of the new year is the perfect time to review your tax withholding and make changes if necessary. LOOK AT THE PAST Start by looking at your 2021 tax return. Did you receive a large refund, or did you have to write a hefty check? In either case, it may indicate your paycheck […]

Get Ready For Tax Time

The new year means it’s time to make your resolutions. But it also means another tax season is here. Take time in January to get organized to make tax filing smooth for you and your tax professional. ORGANIZE YOUR FORMS You’ll receive the bulk of your tax forms by January 31. But if you believe […]

Taxes in Retirement

With Social Security benefit payments increasing nearly 9% this year, you may need to rethink your retirement tax planning. INCOME MATTERS If you started working part-time to offset some of the recent price inflation, this increase in your Social Security payments might make some or more of it subject to federal income taxes. If you […]

Christmas in July!

Last month, we held a 🎄“Christmas in July”🎄 toy drive and challenged our staff to collect as many toys as we could for pediatric patients at Faith Regional. The generosity of our employees and their families was clearly displayed as we were able to donate over 300 toys! Thanks to our employees and their families […]

Lemonade Camp 2022

Our largest camp yet, 80 kids attended! Campers raised $955 for the Norfolk Library Foundation!

BE A TRUE PARTNER: ADD VALUE & CHARGE WHAT YOU’RE WORTH

The National Association of Plan Advisors (NAPA) website shares several articles discussing topics of importance to retirement plan advisors. As expected, there are a few articles about advisor fees (5 in the last 12 months alone). Titles such as “401(k) Plan Fees Continue Downward Trend,” “What’s a Reasonable Fee,” and “A Roadmap to Avoiding the ‘Race to […]

We are joining forces with Integrity Marketing Group!

DALLAS – SEPTEMBER 28, 2021 – Integrity Marketing Group, LLC (“Integrity”), the nation’s largest independent distributor of life and health insurance products, today announced it has acquired WealthFirm, a wealth management and retirement planning firm headquartered in Nebraska. As part of the acquisition, Nancy Brozek and Jared Faltys, Co-CEOs of WealthFirm, will become Managing Partners in Integrity. Financial terms of […]

Lemonade Camp 2021

Nearly 60 campers were able to raise $798 for the Norfolk Arts Center!

New 401(k) Tax Credits and How to Claim Them

January 12, 2021 While tax deductions and exemptions are great, they only reduce your business’s taxable income. Tax credits, on the other hand, reduce the actual amount of tax owed by your business dollar for dollar. Given their strong value, the U.S. government grants businesses certain tax credits to incentivize specific behavior. Let’s take a […]

What is a 403(b)?

What’s the difference between a 401(k) and 403(b) plan? This is a question we hear often. Employees of for-profit firms are eligible for 401(k) plans while employees of certain tax-exempt or not-for-profit organizations are eligible for 403(b) retirement plans. Which Employers Can Establish 403(b) Plans? Churches, public schools, non-profit organizations and hospitals can establish 403(b) […]

How to Choose the Right Financial Advisor for You?

A financial advisor offers advice and expertise to clients based on their financial situation. It’s an important relationship because financial decisions impact your future. You might be wondering how to select the right financial advisor for you and which questions you should ask. This post will answer your questions! Financial Industry Compliances The financial industry […]

Are Profit Sharing Contributions Right for Your 401(k) Plan?

Profit sharing contributions are the most flexible type of employer contribution a company can make to their 401(k) plan. These contributions are not only discretionary, but they can be made to any eligible plan participant – even if the participant fails to make 401(k) deferrals themselves. They can also be allocated using dramatically different formulas […]

DOL Rules that 401(k) Notices Can Be Sent Electronically

On May 21, 2020, The U.S. Department of Labor (DOL) announced final rules allowing required 401(k) plan disclosures to be posted online or delivered via email. This new safe harbor rule was much anticipated since prior to the rule required notices could only be delivered electronically if employees satisfied the definition of being “wired at […]

What’s a Target Date Fund

What’s a Target Date Fund? Determining your retirement timeline helps direct the level of risk for your investment. Target date funds can be used to help build and maintain an age-appropriate retirement investment strategy. A target date fund (also called a lifecycle fund) provides long-term appreciation and capital preservation based on your age or target […]

What is a Plan Sponsor

What is a Plan Sponsor Retirement Plan Consultants assist a variety of people with retirement planning, including financial advisors, plan participants and plan sponsors. In this post, we’ll take a closer look at plan sponsors. A plan sponsor is essentially the company that offers a retirement plan to its employees. Plan Sponsor Responsibilities If you’re […]

How to Get Started with Dimensional Investing

Investors like dimensional funds because they provide consistent income during your retirement. Dimensional’s investment strategies have delivered impressive investment performance. This is why many longterm investors choose Dimensional funds. Before we dive into how to get started with dimensional investing, learn more about dimensional funds in this blog post. You might be curious about how […]

Benefits of Dimensional Funds/Vanguard

Everyone has different retirement goals, and there are a variety of ways to reach them. In this post, we’ll review the benefits of Vanguard and Dimensional Funds. If you have additional questions, please let us know! Vanguard Benefits Vanguard has plenty of notable benefits: Large mutual fund selection—Vanguard offers a collection of more than 3,100 […]

Retirement Income Calculator

Retirement Income Calculator Curious to see your monthly retirement amount? Annual savings, expected rate of return and current age impact your retirement’s monthly income, so it’s helpful to see your future monthly amount. This way you can determine how long your retirement will last. You can use this calculator to determine the monthly income your […]

Performance of Dimensional Funds

Dimensional Funds are unique for many reasons, but performance is an important one. Dimensional Fund Advisors is currently the eighth-largest fund company. It manages assets exclusively for institutional investors and the clients of a select group of fee-based advisers. Those assets were worth $579 billion as of September 2019. Some say Dimensional Funds are actively […]

Do I Qualify?

Click the link below to download a handout that will help determine if you qualify to receive a coronavirus-related distribution. https://retirementplanconsultants.info/wp-content/uploads/2020/07/Do-I-Qualify.pdf

RPC’s Roundtable Discussion on Retirement Plan COVID 19 Relief

View our roundtable discussion on the new CARES Act and what relief options are available for Plan Sponsors and Participants. Topics include: suspending employer contributions, participant distribution and loan options, and freezing a Cash Balance plan.

CARES Act Plan Change Form

Click the button below to download the CARES Act Plan Change form to update your plan’s provisions and take advantage of new distribution, loan, and/or RMD allowances.

Plan Participants FAQs

Click the button below to download a participant frequently asked questions handout, including details on distribution, loan, and RMD options if your plan allows.

Plan Sponsor FAQs

Click the button below to download a Plan Sponsor frequently asked questions handout, including instructions on how to update your plan with RPC to allow for new distribution, loan, and RMD options.

What are Dimensional funds?

Markets go up and down, and dimensional funds provide a steady stream of income in your retirement. Dimensional funds aren’t available to the general public. Instead, investors work with dimensional-approved firms like Retirement Plan Consultants. Benefits of Dimensional Funds in your Retirement Plan 1. Impressive Investment Performance Dimensional’s investment strategies have delivered impressive investment performance […]

Top 10 Takeaways Advisors Need from the SECURE Act

Multiple Employer Plans – The newest “buzz word” in our industry, employers can more easily participate in a MEP or a new variant, a “pooled employer plan,” or PEP. This could be a potential solution for plan sponsors depending on plan size and goals. For those looking for a more custom solution, this may not […]

What to Expect at Year End 2019

In this webinar we will answer common questions that advisors have around year end requirements. -Annual Notice Requirements -Completion of Annual Census Request and using this information for the Annual Compliance Testing. -Key Dates

Cash Balance Plans – What Advisors Should Know

In this webinar we will answer common questions that advisors have around cash balance plans. What is a cash balance plan? Who is a good candidate? How can they be used to improve your clients’ retirement and tax situations? What is the role of the advisor? Presented by Wendy C Frame and Jeremy D Palm […]

The Triple Threat to Employer Sponsored Retirement Plans

One of the most dominating eras in sports history was the Chicago Bulls basketball team from 1991 to 1998. Notably, the ’96, ’97 and ’98 seasons were extraordinary as the Chicago “Triple Threat” was in full effect. The Chicago Bull’s Triple Threat Michael Jordan, Scottie Pippen and Dennis Rodman brought a unique blend of talent […]

Making the Most of Your Practice’s Retirement Plan

Josh Kegley of Retirement Plan Consultants was a guest on the IPWM The Dose podcast hosted by Adam Cmejla. Adam and Josh talked about how to utilize a qualified retirement plan like a 401k to maximize the benefit to the practice owner. The podcasts starts out discussing how changing the match to a safe harbor […]

Converting Your SIMPLE Plan to a 401(k) Plan: Things to Consider

Congratulations! You have decided to take the next step in your retirement evolution and convert your SIMPLE Plan to a full fledged 401(k) plan. While it may seem like a relatively straight forward process, here are some key things to review before pulling the trigger. Is Moving to a 401(k) Really in My Best Interest? […]

Plan Advisor Guide to Fiduciary Oversight

One of the biggest parts of a retirement plan advisor’s value proposition is to facilitate fiduciary oversight for a plan sponsor. While most advisors would naturally like to talk about investment lineups and participant education, facilitating fiduciary oversight is going to protect your client from fiduciary liability as well as improve the overall plan experience. […]

Basics of 401(k) Plan Design

Offering a 3(38) Investment Manager Fiduciary Service – It’s All About Process

A 3(38) investment manager has an incredibly important responsibility when it comes to qualified retirement plans. They are charged with creating the investment policy statement (IPS) for the plan, choosing the appropriate fund lineup based on the IPS, monitoring and reporting the performance of their investment selections, and ultimately mitigating the legal exposure of the plan […]

New Tax Law – What Should Advisors Know

The Long Term Perspective – Is 2018 Out of the Ordinary for the Stock Market

Well……no! But let’s dive a little deeper and flush this out a bit. 2018 is turning out to be not such a good year for global stock markets and investors. As of the writing of this article, global markets are down close to -13% in aggregate. The S&P 500 is looking to mark its first […]

Advising Retirement Plan Opportunities

Getting started in any line of work is tough. Formalizing your ideas, creating an action plan, finding prospects, and delivering on your value proposition takes time, care, and a whole lot of hard work. Becoming a retirement plan advisor is no different. Fortunately, the life source to your future business may already be hiding in […]

Are you Eligible for a Retirement Plan?

It can be difficult to know when a newly hired employee is eligible to participate in your company’s retirement plan, but it is very important as it can help you avoid administrative hassles and mistakes that will need to be corrected at the end of your plan year. That is why we have a couple […]

Record Retention – The “Paper” Trail

As plan sponsors are well aware, the pension law (ERISA) includes specific reporting and disclosure obligations with respect to qualified retirement plans. A lesser known fact is that ERISA also has specific requirements regarding the retention of plan records. Below we answer questions you and other plan sponsors may have about retaining records and the […]

Small Business Retirement Plans

Thank you for tuning into Retirement Plan Consultants YouTube channel. This recording is specifically on small business retirement plan considerations. So your business may be relatively small in size, but you no doubt realized just like the big guys do, that having a retirement plan for your employees can be an attractive benefit. This presentation […]

Reviewing Loan Options

Participants can watch this demonstration to learn what their loan options are, acquire some helpful tips before requesting a loan, and then guide them through the process to request that loan. If you would prefer to read this guide instead, you can follow along with the dialog transcribed underneath this video. During this demonstration, we’ll […]

Answering Your Fidelity Bonding Requirements Questions

As a retirement plan sponsor, you should be aware that every person who handles the property or funds of the plan must be bonded. A field assistance bulletin (FAB) issued by the U.S. Department of Labor provides guidance on fidelity bonding requirements. Understanding these requirements fully will help protect your plan and your business. The […]

Correcting Excess 401(k) Contributions

SITUATION: When we conducted our annual nondiscrimination testing, we found that several of our highly compensated employees had contributed disproportionately more to our 401(k) plan than lower paid employees. Our plan failed the “actual deferral percentage” (ADP) test for the first time. QUESTION: What do we need to do? ANSWER: To avoid possible plan disqualification, you need to […]